The Only Thing We Trust

How To Start FOREX Trading as a beginner: A Self-Study Guide to Trading. The deck is stacked against retail traders. Institutions with more buying power get better pricing, have faster access to information, and get more leeway with margin. Because these obstacles exist, we must trade in line with their limitations to avoid being taken advantage of like the majority of retail traders. We look for short-term trade opportunities with a minimum 2:1 reward:risk ratio.

We are not exposed to the market for a long period of time, which reduces our risk. And the only thing we trust is historical chart markups. Technical patterns repeat in the market. I don’t care what the gurus say. Unless he can show you thousands of trade markups (winners and losers), and explain to you how the parameters of each trade are identical, then you can assume the strategy is not profitable.

The best way to educate someone on how to day trade is to show them real trade examples and walk them through each aspect of the trade, step by step. In our video training courses, I walk you through many trade setups in extreme detail. You’ll see how following a specific set of parameters turns into a profitable trade.

8 PSYCHOLOGICAL EDGES FOR THE ACTIVE TRADER

Forex Market Basics

The foreign exchange market, which is usually known as “forex” or “FX,” is the largest financial market in the world. The foreign exchange market has a daily volume of about $5.3 trillion. This is massive compared to the NYSE, which trades ‘only’ $25 billion per day. The dollar is the most traded currency, taking up roughly 3/4 of all transactions. The euro’s share is second, while the yen is third.

Major Currency Pairs / Our Base Pairs

EUR/USD ……… Euro / United States

USD/JPY ……… United States / Japan

GBP/USD ……… United Kingdom / United States

USD/CHF ……… United States/ Switzerland

USD/CAD ……… United States / Canada

AUD/USD ……… Australia / United States

NZD/USD ……… New Zealand / United States

EUR/GBP ……… Euro / United Kingdom

EUR/AUD ……… Euro / Australia

Benefits Of An OTC Market

Forex is an Over The Counter (OTC) market due to the fact the entire market is run electronically, within a network of banks, continuously over a 24 – hour period. This means that the spot forex market is spread all over the globe with no central location.

Advantages of Forex Over Other Asset Classes:

● Low capital investment required to open an account. You can get started with as low as $100, depending on the broker.

● It is a Spot market, meaning that currencies are available to trade immediately or “on the spot” with the current market price presented by your broker.

● Quick execution. You’ll never have to search different brokers to get trades done.

.● 24 hour liquidity. The forex market is opened 24 hours per day, 5 days per week, Sunday 5:30 EST (for most brokers) through Friday, at 5:00 P.M. (again, time depending on broker).

Margin & Leverage

In forex, the margin is the minimum required balance to place a trade. The margin requirement allows traders to hold a position much larger than the account value.

The curse and blessing of currency trading is leverage. It can lead to fantastic gains, but it can just as quickly, cost you a lot of capital. Proper risk management must be applied when using high leverage to avoid blowing your account. Leverage does scare people, and rightly so. Without proper knowledge and account management, you can quickly find yourself on the wrong side of a margin call. On average, most currency pairs do not move more than a small percentage on a daily basis.

Because of this, we are able to get higher leverage than any other asset class. In fact, some brokers offer as much as 1:1000, and even 1:3000 leverage. Traders that understand and respect leverage can use it to their advantage. However, we must be careful with leverage. It is easy to fall into oversized positions that put one’s account at risk. It is important to fully understand how leverage works before using it with real money. And, you don’t need extreme leverage for sufficient returns.

The Language of Forex

The foreign exchange market has its own language, and it’s important that you learn it.

Pips

The basic unit of value is a ‘pip.’ I read pips by counting the 2nd decimal place from the right as the ones digit. The 3rd decimal spot from the right is the tens digit, and so on.

Example: EURUSD is priced at 1.34567

1.34567 – the 6 is the pip

1.34567 – the 7 is the pipette

1.34567 – 1.34667 – increase of 10 pips

1.34567 – 1.35567 – increase of 100 pips

Spreads

When you buy a currency, you will use the offer or ASK price. When you sell, you will use the BID price.

Example: EURUSD Bid @ 1.34567, Ask @ 1.34547

The spread here is 2 pips – 1.34567 // 1.34547

To figure the amount in dollar terms, multiple the spread (2) times the cost per pip. (cost per pip depends on your lot size). For example: if you were trading a .01 lot size and the spread is 2, the cost in dollars is: spread (2) X lot size ($.10) = cost of trade $.20

You want to work with a broker that charges a spread or commission on your trades. That’s a good sign that your orders are being properly handled.

Lot Size

Lots are the number of units of currency that you choose to purchase at one time.

Standard: 1.0

100,000 units of currency

Approx. $10 per pip (depending on which pair you are trading). The big banks that control the market trade 1,000+ standard lots at a time

Mini: 0.1

10,000 units

Approx. $1 per pip

Micro: 0.01

1,000 units

Approx. $0.10 per pip

Lots are what can make a 10 pip trade be worth $10, $1,000, or $100,000. With proper use of leverage, you can trade larger lots for increased trading ammunition.

Order Types I Use

Market Order

Your order will be executed at the most current price available We use this 99% of the time.

Limit Order

A limit entry is an order placed to either buy below the market or sell above the market at a certain price.

Stop Order

A stop entry order is an order placed to buy above the market or sell below the market at a certain price.

Stop Loss

A stop-loss order is used to protect your account balance if a trade turns against you. These orders trigger automatically when the stop price you set is hit. If you are long a trade, your stop loss would be at a lower price than your entry. If you are short trade, your stop loss would be at a higher price than your entry.

Session Times

There are 3 major sessions to focus on. We only look to trade pairs that are open during their respective session. For example, we would never trade a USD pair in the Asian session.

Asia – 7pm-1am: the initial High and Low are set for the day

London – 1am-7am: Volume builds, moves become larger, and more setups can be found.

New York – 9am-11am: most large moves in NY are before lunch We focus on the NY session. This is the when the most volume is being traded, other than during the London session. Without volume, you cannot have volatility. Volatility creates opportunity. The patterns and strategies we use present in every session. There has been plenty of times where I see trades the next morning and wish I was awake for the London session the night before. However, I have learned that in order to succeed in day trading you must be rested and focused. Waking up at 2am to trade after working all day is not the best idea if you are trying to be well rested.

Days of the Week

Statistically, we have found that Monday-Thursday is the most profitable trading day for our patterns. Friday is the least. Blame this on whatever market forces you like, but again, we trust the numbers and avoid trading Fridays.

Psychology of a Winning Trader

Treat Trading as a Long-Term Business

Be realistic. You won’t be able to quit your day job from your first $500 account. That shouldn’t come as a shock. You are in this business for the long run. You can’t “get rich quick” day trading. However, if you survive long enough, you will come out on top and earn your financial freedom. If you study professional traders, you will find that they all practice extreme levels of patience. They never judge themselves based on one trade. They always are playing the long game, focused on the future, and thinking only about the big picture.

Survival is the key.

We tell any prospective student that if you survive long enough, you will eventually find a strategy that works for you and takes you to profitability. The only problem is that most people run out of money before they learn to control their emotions. Businesses do well when emotions are not involved. Emotions cloud judgment and increase bias. There is no room for any type of bias in your trading.

Find a Strategy That Works For You

We trade technical patterns because they repeat. They are not hard to identify once you understand what you are looking for. We approach the market with a cynical mindset. This allows us to be on the opposite end of the majority of retail traders. We look for short-term opportunities with a minimum of 2:1 reward-risk ratio. Our strategy is used differently by each trader because of their personal tendencies. Our students have room to grow independently within the group and become self-sufficient day traders.

One of those important characteristics is to find and stick to a strategy that fits your personality. Professional traders spend time each day studying self-development. The truth is, the more you know about yourself, the better your trading will be. One of the biggest pitfalls new traders make is to bounce from strategy to strategy. These people quickly blame the strategy they are using for their losses. In this situation…

The problem is not the strategy… the problem is the trader. The fact remains that you must first discover yourself, in order to then find a profitable day trading strategy that aligns with your personality.

Make Everything a Yes/No Decision

As you work through your checklist before you are about to enter a trade, you will go through the list of parameters that must be met. You must answer all of these questions with yes or no answers. Straying from this in your discipline can be detrimental to your trading. There is no room for “kinda” in the markets.

By learning to attack the markets with this ‘yes/no’ attitude, it helped me become a better decision-maker. By backing yourself into either, a yes or no answer, you remove the emotion involved in that situation. Everything in the universe is neutral. Your emotions and biases are what creates the perception of each event that you take part in. By using yes or no questions, you are looking at everything neutrally, with no emotion or bias.

Technical Analysis for Forex

Candlestick Charts

My charts look different from 99% of other traders. Why? Because my candlesticks have no colors. They are either black or white. I found the red and green colors on most charts to be distracting. understand two types of candles to identify them regardless of color.

Bearish Candles: Open at the top of the candle body and close at the bottom.

Bullish Candles: Open at the bottom of the candle body and close at the top.

Wicks: The top wick shows the high and the bottom wick shows the low of the given time period.

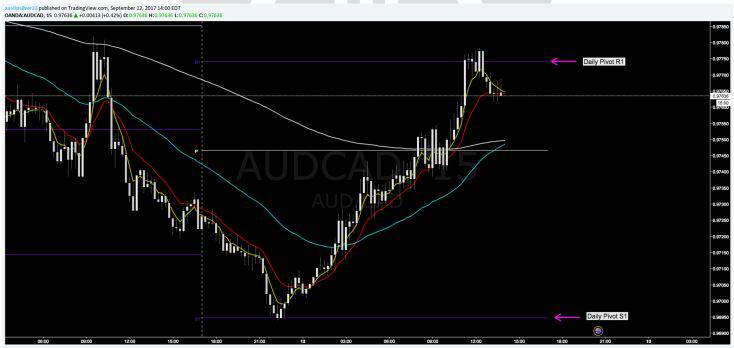

Each candle tells a different story depending on which time frame you are looking at. We use the 15-minute chart for formations and trend validation, and the 1 and 5-minute charts for entries and exits.

Here are two photos of AUDUSD, one with colored candles and one with neutral candles. The green candles are bullish, the red candles are bearish. Once you understand the difference between bullish and bearish candles, the colors become an emotional distraction. The color of the candle has no significance.

Exponential Moving Averages

EMAs are when used correctly, extremely powerful tools. An EMA applies weighting factors that decrease exponentially. The weighting of old data points exponentially decreasing gives much more importance to recent observations, while still not removing old observations entirely. Our backtesting proves that EMAs can be used as a powerful tool to help identify repeatable patterns that correlate to winning trades. The 8, 13, 50, 200, and 800, EMAs are the most important for our group.

Pivot Points & Average Daily Range

Each pattern we use has a predetermined take profit level. However, if a pivot point happens before the take profit level, we may exit early. Using pivot markers (purple horizontal lines) with Average Daily Range (ADR) is how we determine to take profit levels. Pivots are calculated using the last day’s open, high, low, and close. ADR is calculated as an average of the currency pair’s daily pip movement over the previous five trading days. If a pair has hit 80% of its ADR for the day when we are looking to enter a trade, we turn away. You can’t catch every single trade that presents. Know your setups and stick to them.

Traders Dynamic Index (TDI)

Using a confluence of indicators allows us to find the tipping point in the market. The EMA’s are great but are not the first thing we look at when analyzing a chart.

● Relative Strength Index (RSI)

- ○ Does not react to price spikes

○ Used for spotting divergence and over bought and over sold conditions● Trend Line – Moving Average applied to the RSI

● Market Baseline (Liquid 50, L50) – Moving Average applied to RSI

What Separates the Most Successful Traders

From studying the most successful day traders of all time, we see that there are specific characteristics that all profitable day traders must-have. Not all of these are innate. Some of these traits must be practiced and refined daily, over the course of years in the live market.

Trust the Process

All high-income skills require time. Whether you want to be a doctor, lawyer, or trader, you must put the time in. If these fields of study were easy, everyone would be doing them. Don’t rush the process. I have seen people lose large amounts of money because they could not handle the short-term pressure that comes with trading. They rushed and failed. Some over-leverage themselves and others put every free dollar they have behind a different strategy each week. Some people just throw money at the market thinking “things will just work out.” The only thing that you “figure out” from rushing the process, is how quickly you can burn through your bank account.

Great traders are in love with the charts. They spend more time studying and testing charts than they do actually trading them. They study themselves, their characteristics, their trading, and the markets, all in the endless pursuit for a life of freedom and prosperity…and they enjoy every second of it. If you have the audacity to think you are good enough to eventually be a full-time trader, you need to fully understand the ins and outs of the market. You need to be obsessed with learning its nuances and that can only come with time. You must trust the process to master the game.

Discipline

Discipline is more than training yourself to obey a code of behavior. Discipline is a branch of knowledge that you are attempting to master, and it is a foundation for success. I asked a few students of mine, what tips they would give to themselves if they could go back in time to when they began trading. This is what they said.

● Stick to the exact parameters of your strategy. Remember, everything has a binary solution.

● There will not be trades every day. You will have to resist the urge to trade unless the entry parameters are met to their full requirement.

● You will miss the winners. Accept that before you even begin day trading. The markets are made of money…literally. But that doesn’t mean it is all for you.

● You will lose trades. Keep in mind, trading is a game of probabilities. You only have to be right the majority of the time, not all of the time. Cut losers quickly.

● Do not over-leverage your account to hit a home run on one trade. You’ll crash and burn very quickly.

● Do not focus on one day’s results. Keep the bigger picture, of the week or month, at the top of your mind.

● Be unbiased. Trade any pair, in any direction, if the signal presents.

● Once you understand how to make winning trades, it will become addicting. Prepare for that addiction, and do not become emotional when you begin to win. Stick to the method that got you to that point of success.

Emotions

Your emotions have a huge impact on your trading. Even if you believe that you are some, stone-cold trader who looks at the market completely unbiased, I promise you’re just fooling yourself. Don’t fight the emotions of day trading. Understand their meaning and use them to your advantage. There is no room for lying to yourself on the road to profitability.

You might think you have a beat on the market, but unless you are pulling out withdraws weekly (in which case, I doubt you’re reading this eBook), then you are only lying. My team wants to hand-deliver a profitable trading strategy to you. We have done the research and backtesting to prove that. You are responsible for implementing our strategies, removing your own emotions and biases, and executing winning trades. Our video training courses will teach you how to harness the emotions created when day trading in a live market.

“Pain plus reflection equals growth and greatness.”

Pay Attention to the News

We avoid trading during high-impact news.

For example, if there is high-impact news pending on GBP at 8:30 am, I will not be in any GBP trades when that news is released. Depending on how the news impacts the charts will determine if I can trade that pair at all for the remainder of the day. We will also avoid trading economic events like the nonfarm payrolls report and when the Fed chair is speaking.

News can shake up the market. If we find large or irregular-sized candles, we avoid that chart completely for the remainder of that day. We also recommend keeping some type of major news network running as you trade…you never know what can happen next in this day and age! We’re almost done!

Closing Remarks

These are the most important things I’ve learned as a full-time forex day trader:

● Patience is now your #1 priority. If you give put in the time and effort, you can can create any lifestyle that you wish to live.

● Look at everything in a binary way, it’s yes or no as you go!

● Have reasonable expectations. Very few people can take a $10,000 account to $100,000 in a year. Be sensible.

● Accept that you miss winning trades. There is always another one.

● Document and study your trades so you can learn from them.

● Do not be fearful in your winners and do not over commit to a loser.

● Cut your losses fast. You can never know EXACTLY What point the market will move to so you can’t be stubborn.

● Trading multiple patterns or strategies doesn’t make you money or make you smart.

● Do what we do: focus on the correct implementation of proven strategies, and avoid the bright shiny objects.

ABOUT THE AUTHOR: AUSTIN SILVER

Senior Forex Analyst

Not long ago, I was working for a Fortune 500 Investment and Insurance company, studying for the Series 7 exam, when I discovered what day trading was. I quickly became obsessed with the potential that day trading offered. I dropped everything and went all in on the idea that I could earn an uncapped income from anywhere in the world. But success didn’t come easy. I started out with two penny stock courses that taught me nothing except basic technical analysis. From these courses, I learned what the ‘Pattern Day Trader Rule’ was, and how it restricted my earnings potential, I looked for an alternative. That’s when I discovered Forex. The first six months were rough. Like many new traders, I was obsessed with finding a prepackaged “holy grail.” After spending 18 months and thousands of dollars on different education courses, signal services, guru chat rooms, and mentorship programs, I came to the understanding that I needed to do the work myself. I couldn’t believe any results unless I was creating them myself, with my own strategy, and my own testing.

I felt like these companies were out to suck fees from me. They didn’t care if I was actually making winning trades. They will do, say, and promise whatever they must in order to keep your business. After months of trial and error testing new strategies, we were able to identify a pattern that repeated and the basic parameters of a winning setup within that pattern. This became known as the S1 Pattern. I knew we were headed in the right direction with this pattern when our backtesting and chart markups showed a 90%+ win rate during the New York Session throughout the previous 6 months. As time went on, we continued experimenting to come up with even more strategies. As we refined our parameters, newer patterns began to present themselves. This led us to our most profitable day trading strategy to date, the S2 Pattern. The S2 pattern changed the game. It shows up daily in almost every session. It requires advanced knowledge of our strategy, a high level of discipline, and dedication to precise execution. Turn the page so you can learn more about it.

The S2 is designed to show us the exact moment to make an entry. It’s the culmination of backtesting, 2.5 years of live trading, and daily markups. We teach all the entry/exit parameters in qualifications in our course. Because the S2 is a combination of several indicators (including TDI and exponential moving averages), it gives us entries before off-the-shelf indicators. You can get in before your competition. This means pain-free entries on powerful breakouts. Time frames are also key. When we see S2 crosses on our key 3 time frames, we know a major move is coming, and we can get in before the crowd sees the opportunity. And we eliminate a feeling that can destroy your account: F.O.M.O. or the “Fear of Missing Out.” No more “coulda, woulda, shoulda” as a trade goes to the moon without you. Best of all, the S2 shows up every single day, which means consistent moneymaking opportunities. To my knowledge, there is no other forex strategy with the same combination of exact entry parameters, specific take profit and stop loss levels, and proper risk/reward ratios, with the backtesting to prove it. Our video training courses explain the parameters of the S2 trade setup, how to enter and exit properly, how to manage and grow your account like a professional, and how to instill the extreme levels of discipline required in order to become a profitable day trader.

SOURCE: GETTING STARTED IN CURRENCY TRADING A Beginners Guide Into The Forex Markets By Austin Silver http://www.t3live.com

Other Posts:

- Expecting the Good Book by Brigitte Cutshall Review

- Leaders Who Ask Book by Corrinne Armour Review

- 2000 Most Common German Words in Context by Lingo Mastery

- Hacking Digital Growth 2025 by Constantin Singureanu

- How To Place Order for Spare Parts for the Toyota Land Cruiser?

- BMW i Vision Concept Car of 2040 is 100% Recyclable

- Auto Finance Vs. Lease: Everything you need to know before and after

- Automakers Build Engine Parts from Recycled Aluminum

September 25, 2021

[…] How To Start FOREX Trading as a beginner: A Self-Study Guide to Trading […]