Accounting Quickstart Guide: The Simplified Beginners Guide to Real-world Financial & Managerial Accounting for Students, Small Business Owners, and Finance Professionals by Josh Bauerle

About The Book:

If someone told you that learning accounting could be fun, you might be a little skeptical.

Meet Josh Bauerle, a reluctant accounting student turned super CPA and author of the Accounting QuickStart Guide, 3rd edition.

This is the revolutionary book that expertly simplifies accounting fundamentals. It’s an invaluable resource for accounting students, business owners, bookkeepers, and other finance and recordkeeping professionals worldwide!

Whether you are a business owner looking to boost your bottom line or an accounting student looking to boost your grade, this book will prove indispensable on your journey to knowledge.

CPA, Josh Bauerle’s down-to-earth approach to accounting and business strategy has been featured on the Hallmark Channel’s Home and Family show, the GenY Success show, Profit First Professionals, and on several other contemporary business media venues.

Why do accounting students, business owners, and finance professionals love this book so much?

• The Accounting QuickStart Guide explains and simplifies the core principles of accounting in a way that eludes most accounting professors. Key concepts are introduced alongside an abundance of entertaining and clarifying examples, providing fast and effective mastery of the material.

• Business decision-makers and accounting students alike appreciate the practical, real-world approach to the subject. This approach is consistently exemplified throughout the Accounting QuickStart Guide. A clear and simple path to reader education—not confusing jargon—is the order of the day.

• Get ready to experience learning breakthroughs. Concepts in the Accounting QuickStart Guide are presented with the assumption that the reader has very little to no knowledge of accounting. The path to learning begins at the beginning and culminates in new knowledge, new skills, and unmatched satisfaction!

Who is this book for?

• Business owners and managers looking to apply the power of accounting in small, medium-sized, and enterprise-class businesses.

• Accounting students at the high school, undergraduate, or graduate level.

• Business students looking to develop a well-rounded grasp of accounting fundamentals.

• Bookkeepers and financial professionals who want to increase their job proficiencies through the application of accounting fundamentals.

• Accounting professionals looking to reboot their understanding of the core principles of accounting, as well as accounting experts looking to sharpen their skills.

You’ll learn,

•The logic and methods of classic double-entry accounting—what it is and how to apply it.

• Business entity types; their pros, their cons, and their essential financial statements!

• The fundamental accounting equation, Assets = Liabilities + Equity; how everything in the financial world can be explained using this simple equation.

• Financial accounting, managerial accounting, tax accounting, and other universes within universes, all brought down to earth.

• All about GAAP standards and why they matter to accountants.

• How to increase your profit margins and fraud-proof your business using simple accounting tactics.

Accounting is known as the true “language of business.” If you’re ready to find your fluency and boost your bottom line (or your exam scores), then the Accounting QuickStart Guide is your educational trailhead. Get it. Read it. Enjoy it. Consider it the first of many good decisions you’re soon to make, thanks to your newfound endeavor as a moonlighting CPA.

Featuring sample exercises and quiz questions, plus other bonus materials you can use to fine-tune your accounting know-how; buckle in, you are on your way to becoming an expert! (Published by ClydeBank Business)

About The Author:

Josh Bauerle is a CPA and the founder of CPA On Fire, a tax and accounting practice specializing in working with online business owners.

Over the course of his ten-plus years in the industry, Josh has experienced a wide range of roles in the accounting world: cost accountant at a Fortune 500 company, auditor and tax preparer at a public accounting firm, financial advisor, and, finally, owner of his own firm. This experience has allowed him to see firsthand the importance of proper accounting at all levels of business, from the billion-dollar companies to the guy starting an Amazon store from his basement.

Since founding CPA On Fire in 2012, Josh has become a sought-after expert in the accounting and tax industry, appearing on some of the largest business podcasts in the country and on national TV shows.

Josh lives in Willard, Ohio, with his wife Courtney, twin boys Jacob and Eli, and daughter Mollie. When he’s not helping business owners with accounting, he is coaching the Willard Lady Flashes tennis team, which just completed the school’s first-ever undefeated regular season and SBC Championship.

Education: Kent State University Bachelors, Accounting

One of only 180 universities worldwide to achieve dual accreditation in both business and accounting from AACSB International, the longest-serving global accrediting body for business schools that offer undergraduate, master’s, and doctoral degrees in business and accounting.

My Review:

Appearance:

I’ve received the paperback book, and I liked the cover design and paper quality, but the printing is really poor. (Printing is Off-Center)

Content:

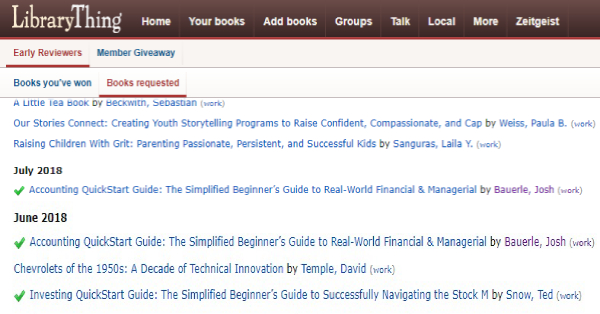

As you see on the screenshot below, I’ve won this book in the LibraryThing review program twice, but I didn’t receive it in June, and for the second time I’ve won it in July and received it about a couple of days ago.

It was the winter of 2008, I was running my own Power Tools Shop, a successful small business for about 4 years, one day one of my closest friends, Philip came to me and asked me to discuss an opportunity with him, He started talking about an idea to establish a business in the construction industry which he already was familiar with and had a great reputation in.

He asked me to close down my shop and start the new Int’l business with him as his business partner. long story short, I accepted and closed my shop, getting all my funds together, and began with his great idea.

I knew that new business was going to have a huge daily transaction (a lot more than my small business), and my concern was how we can afford a bookkeeper or CPA? thankfully Philip was professional and experienced enough to do the bookkeeping until we could afford to hire an accountant and more employees.

What I’m trying to say is, if I had this book on that day, I wouldn’t have any concerns or worries about taking care of our company’s finances.

I’ve read this book in 2 days, which doesn’t mean it’s easy to understand or not important, but because I had to share my honest review with the Author as soon as I could.

This book includes not just accounting sections but some useful tips on how to write The Financial Section of a Business Plan such as FINANCIAL STATEMENTS, Balance Sheet, FINANCIAL STATEMENT ANALYSIS, Methods of Depreciation, ASSETS, LIABILITIES, and Equity which were really helpful to me because currently, I’m writing my business plan.

The author began with the introduction of ACCOUNTING AS A TOOL OF BUSINESS, and a great explanation of Business Entity Types and the way your business will be taxed. (really helpful especially if you haven’t registered your company yet). He broke down Branches of Accounting to Bookkeeping, Financial Accounting for External Parties, Managerial Accounting for Internal Parties, Income Tax Accounting as the four most essential and prevalent accounting branches.

You’ll also find a chapter on MONITORING STOCKS & INVESTMENTS in this book with some useful information especially to know-how stocks and investing is connected to all businesses.

The most interesting part of the book for me is chapter 9: Detecting and Preventing Fraud.

I really liked the way that the author covered this chapter and explained how Ethics and fraud prevention are critical aspects of accounting, Accountants, and bookkeepers, as well as any business professionals, are handling sensitive financial records and they must exercise an exceptional degree of ethical decision-making and scrutiny.

There are a lot of True stories about trainers, bookkeepers, etc, of fraud that affecting companies of all sizes and involving all types of perpetrators. Small-business owners may hold the mistaken impression that their close-knit, family-like work environment makes them immune from fraud.

I give a truly 5-star review out of 5 because of all those reasons that I mentioned above, and I truly suggest you order it today especially if you’re trying to handle your own or business finances. It is very easy to understand and grasp, you will learn a lot from it.

I’d like to thank John Donnachie and Clydebank Media for providing me a copy of this book along with other digital materials including modules, video content, and free access to all these great materials on their website in exchange for honest and unbiased feedback for the book.

Did you Know (Book Articles):

Fraud comes in many flavors and its culprits span all ages, genders, colors, and creeds.

- True story: a trainer at a medical insurance company was in charge of training new personnel on how to submit claims to the accounts receivable department for payment. As part of the training, she would send in fake claims with fictitious payees and was responsible for notifying accounts payable so they would not pay out any claims to health care providers that did not exist. Because there was little control exerted by the insurance company over claim submissions, the trainer chose to set up a couple of fake companies, under her control, and to use these fake companies as fictitious payees when training new employees. The trainer intentionally failed to notify the accounts payable department when using her own companies for training purposes. Over time, accounts payable paid out some $11 million to fake companies controlled by the fraudster.

- Another true story: a bookkeeper at a construction company was in charge of reconciling bank statements (checking bank records against internal accounting records) and was also a clerk in accounts payable—a dangerous combination of duties from the outset. She defrauded her company by submitting expenses to be paid that were not real expenses. The supervisor would sign the checks, and the fraudster would then white out the payee line of the check and write in the name of an account that she controlled. The end result was $570,000 worth of criminal embezzlement.

Good accounting practices can keep a business legally compliant while minimizing its tax burden. From the retail storefront tax professionals who help individuals file their income taxes in April to the accounting firms hired to handle the complex income taxes of Fortune 500 companies, income tax services are representative of an enormous industry. The reality is that almost every individual, business, and nonprofit is required to dutifully and accurately file and pay (if they owe) income taxes. The certainty of taxes—of a nature second only to death—ensures that accounting remains a highly stable, high-demand profession.

Don’t Be a Stranger

As I may have mentioned a time or twenty, I am a CPA. My clients are generally smaller businesses, and I am developing a bit of a niche for myself in the online retail space: Amazon, Etsy sellers, etc. If you would like some personal support or guidance on your tax predicament or other financial matters affecting your business, please feel free to contact my office. The easiest way to contact me is through my website: CPAonfire.com/contact.

I always write my reviews on Amazon, 3ee, Goodreads, Librarything, and Social Media such as Facebook, Instagram, Twitter, Linked In, Telegram, and Google+.

If you also have read this book, please share your review below, we greatly appreciate your comment, and let’s talk!